Expand Your Value with Streamlined

Wealth Management

Boost profitability and enhance the client experience.

Transform your practice with intelligent, comprehensive solutions that combine institutional-quality investment management with streamlined operations - all designed to help you deliver exceptional client outcomes at scale.

Human-Centered Investing

Provide tailored, tax- efficient strategies that align with each client's unique investment goals, constraints, and risk tolerance.

Turnkey Asset Management Experience

Enhance your capabilities with a powerful investment platform that integrates effortlessly with Black Diamond's portfolio reporting and client communication tools.

Optimize Your Operations

Increase your team's efficiency with tax-smart proposals and streamlined rebalancing.

Drive Your Growth Upmarket

Leverage a team with the institutional firepower to help you win your largest prospects.

Black Diamond Capabilities

Trading & Rebalancing

Transform portfolio management with an intelligent engine.

Enhanced Modeling

Build and manage models with N-tier architecture and security equivalent tracking.

Tax-Efficient Rebalancing

Minimize tax impact with strategic asset location and automated loss harvesting.

Proactive Monitoring

Stay ahead with alerts for cash needs, drift, and tax-loss harvesting opportunities.

Straight-Through Processing

Execute trades seamlessly through the FIX network with secure approval workflows.

Embedded Experience

Leverage workflows for seamless cash management, reconciliation, and more.

Model Marketplace

Access a curated ecosystem of investment solutions.

Diverse Strategies

Choose from a suite of cost-efficient, open-architecture ETF model portfolios and separately managed account strategies.

Custom Integration

Seamlessly incorporate your own proprietary strategies alongside third-party model portfolios.

Automated Updates

Keep portfolios aligned with model updates.

Deep Analytics

Access comprehensive model documentation and performance analytics.

Proposal Generation

Create compelling, personalized investment proposals.

Goals-Based Portfolio Construction

Align investment strategies with specific client objectives.

Advanced Modeling

Juxtapose current and proposed allocations with risk and return statistics and Monte Carlo simulations.

Tax-Smart Transitions

Create personalized proposals by incorporating risk, tax, and other investor constraints into real-time tax-aware portfolio optimizations.

Client Portal Integration

Share proposals and updates through a secure client portal.

Interactive Reporting

Generate white-labeled, customizable proposals.

Managed Accounts

Maximize efficiency with turnkey investment management solutions.

Streamline Model Assignments

The Model Marketplace offers free access to browse and subscribe to SS&C ALPS Advisors’ managed Models or Strategies.

Managed Account Services

Partner with the team of strategists, portfolio managers, and traders at ALPS Advisors for outsourced trading and rebalancing solutions within your Black Diamond experience.

Turnkey Asset Management Experience

Enhance your capabilities with a powerful investment platform that integrates effortlessly with Black Diamond’s portfolio reporting and client communication tools.

Generate Customizable Proposals

Proposal Generation’s intuitive data collection and creation processes enable advisors to prioritize client interactions and strategic planning, reducing the risk of errors common in manual data entry.

Optimize Your Operations

Increase your team’s efficiency with tax-smart proposals and streamlined rebalancing.

Drive Your Growth Upmarket

Leverage a team with institutional firepower to help you win your largest prospects.

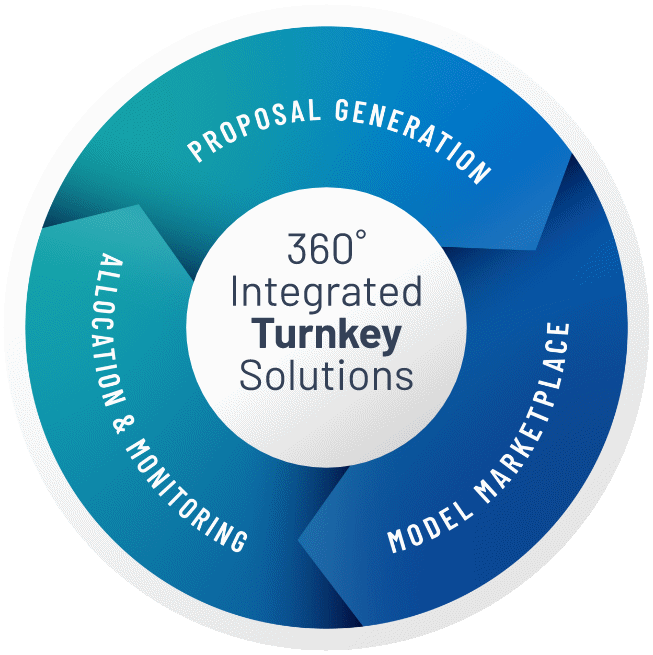

360° Integrated Turnkey Solutions

Outsourced Chief Investment

Officer (OCIO)

Enhance your services and elevate your practice with expert investment leadership.

Manager Selection: Benefit from the due diligence and oversight of institutional asset allocators.

Model Construction: Co-create or outsource the design of custom model portfolios that fit the needs of your practice.

Capital Markets Assumptions: Access monthly expected returns, risk, and correlation across dozens of asset class segments and private markets.

Investment Strategy: Access institutional-quality research and quarterly economic commentary.

Risk Management: Implement sophisticated portfolio monitoring and risk oversight.

Deliver Excellence at Every Corner of Your Business