Staying Connected with You

The goal of this page is to keep you connected with the work that we are doing at SS&C Advent and Black Diamond.

Not finding what you are looking for? No problem, simply email me as I’d be happy to help.- Jenny Schuster

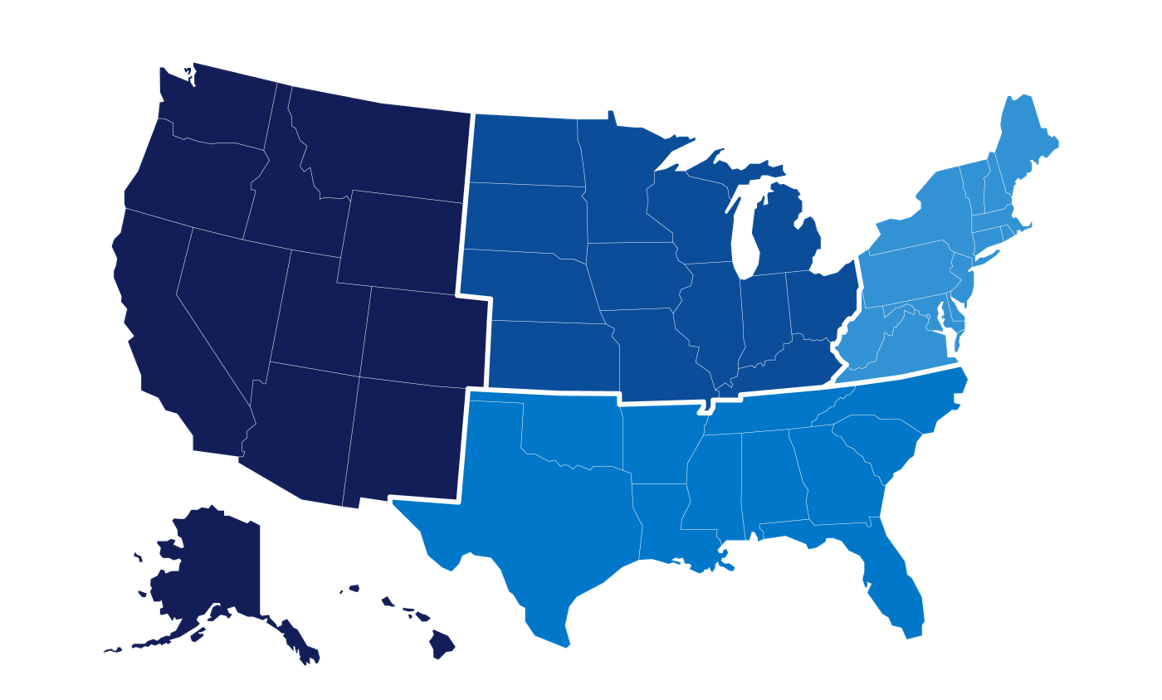

Meet Our Sales Teams

To serve the unique needs of your clients and prospects, our sales team serve territories based on a firm’s location and asset size. Feel free to reach out to anyone on the team as they are ready to help.

Contact us with any questions you may have about Black Diamond or other SS&C Advent solutions.

info@advent.com

(800) 727-0605

Sales Team

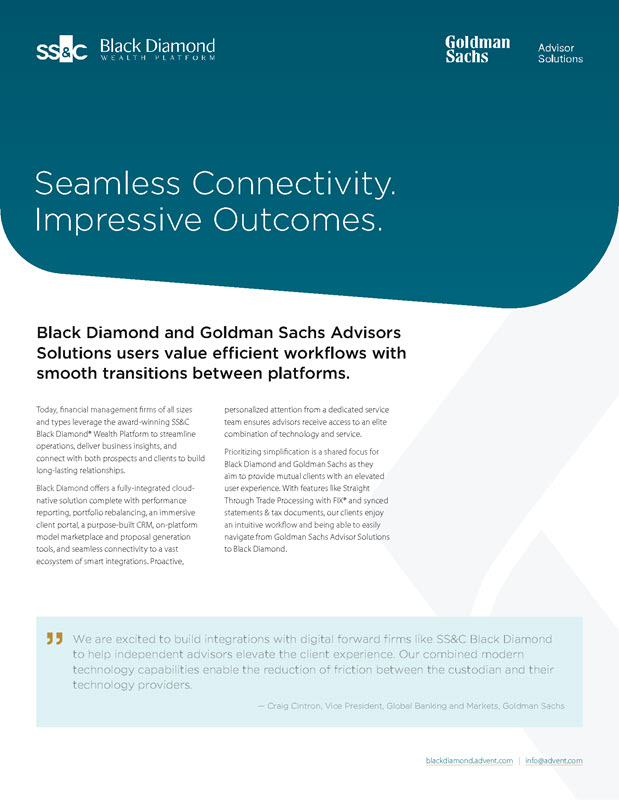

Goldman Sachs Integrations

Our integrations with WealthscapeSM have allowed us to take the Black Diamond user experience to the next level. Simplification is key, and with the addition of features such as Straight Through Trade Processing with FIX and bi-directional Single Sign On, our mutual firms can now enjoy an intuitive workflow, easily moving between platforms.

Single Sign-On from Black Diamond to Advisor Access

Straight Through Trade Processing via FIX

Cost Basis Sync

Synched Custodial Statements & Tax Documents

Recent Enhancements

Every six weeks, the Black Diamond team releases platform enhancements that ensure your advisors are compliant and have access to the latest, innovative functionality. Learn more about some of our most recent enhancements.

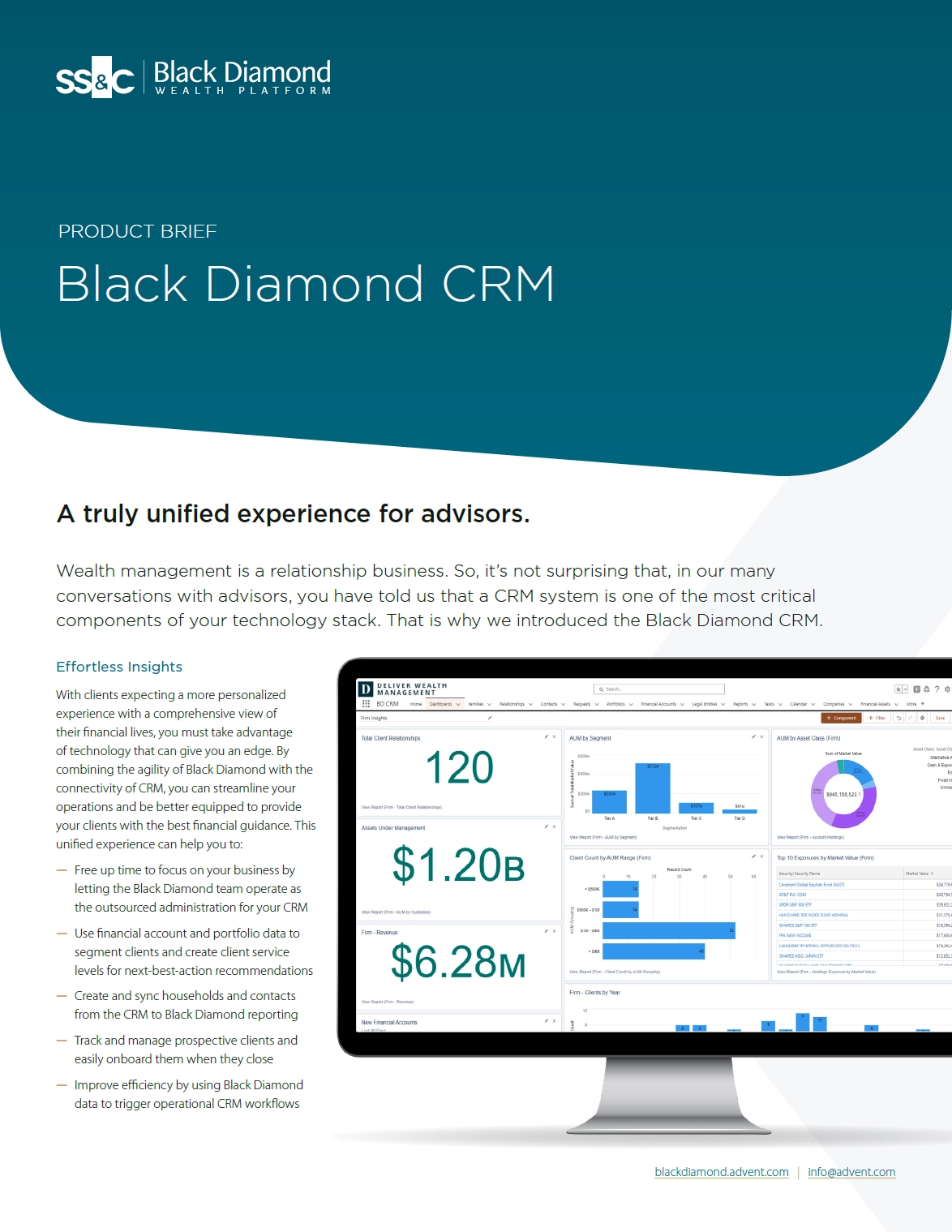

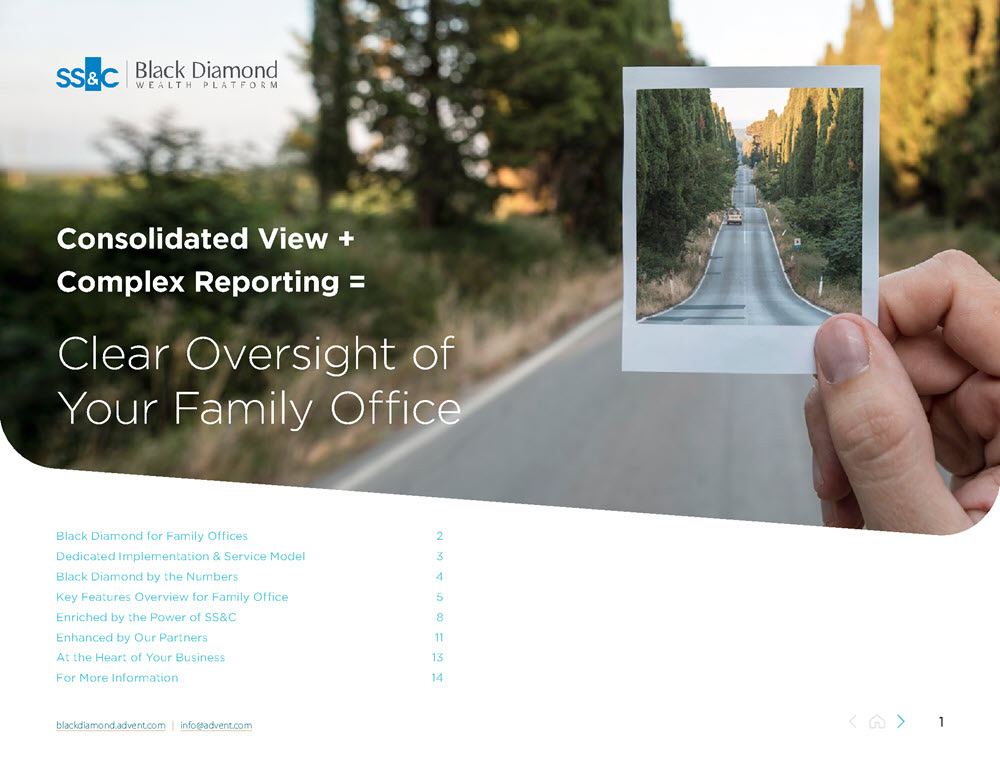

Black Diamond Resources & Collateral

To help you learn more about the Black Diamond® Wealth Platform, please reference some of our most commonly requested marketing materials below.

Product Previews & Key Functionality Demos

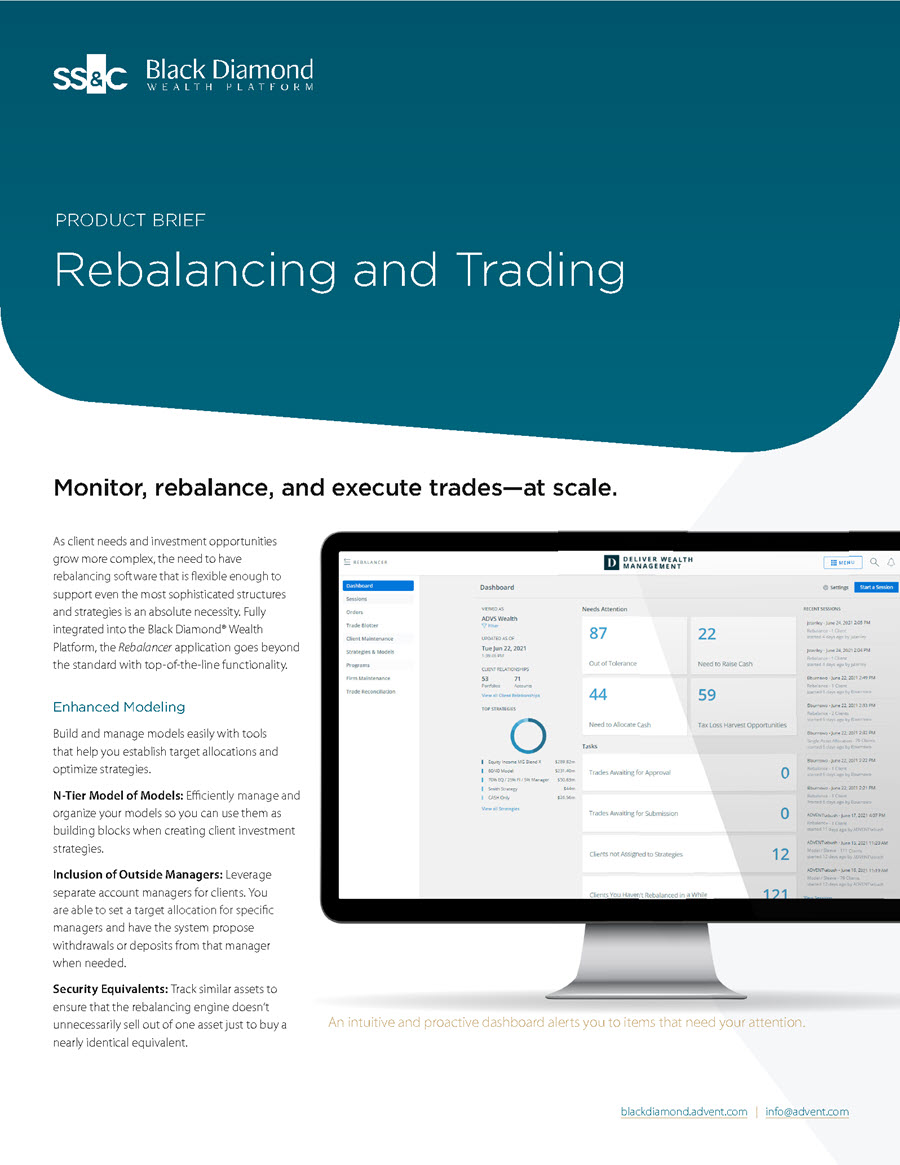

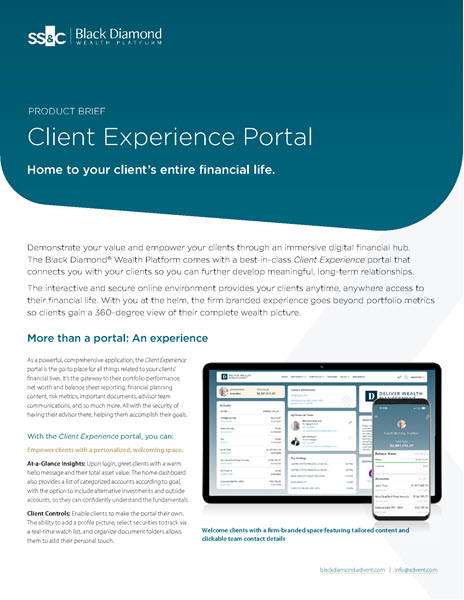

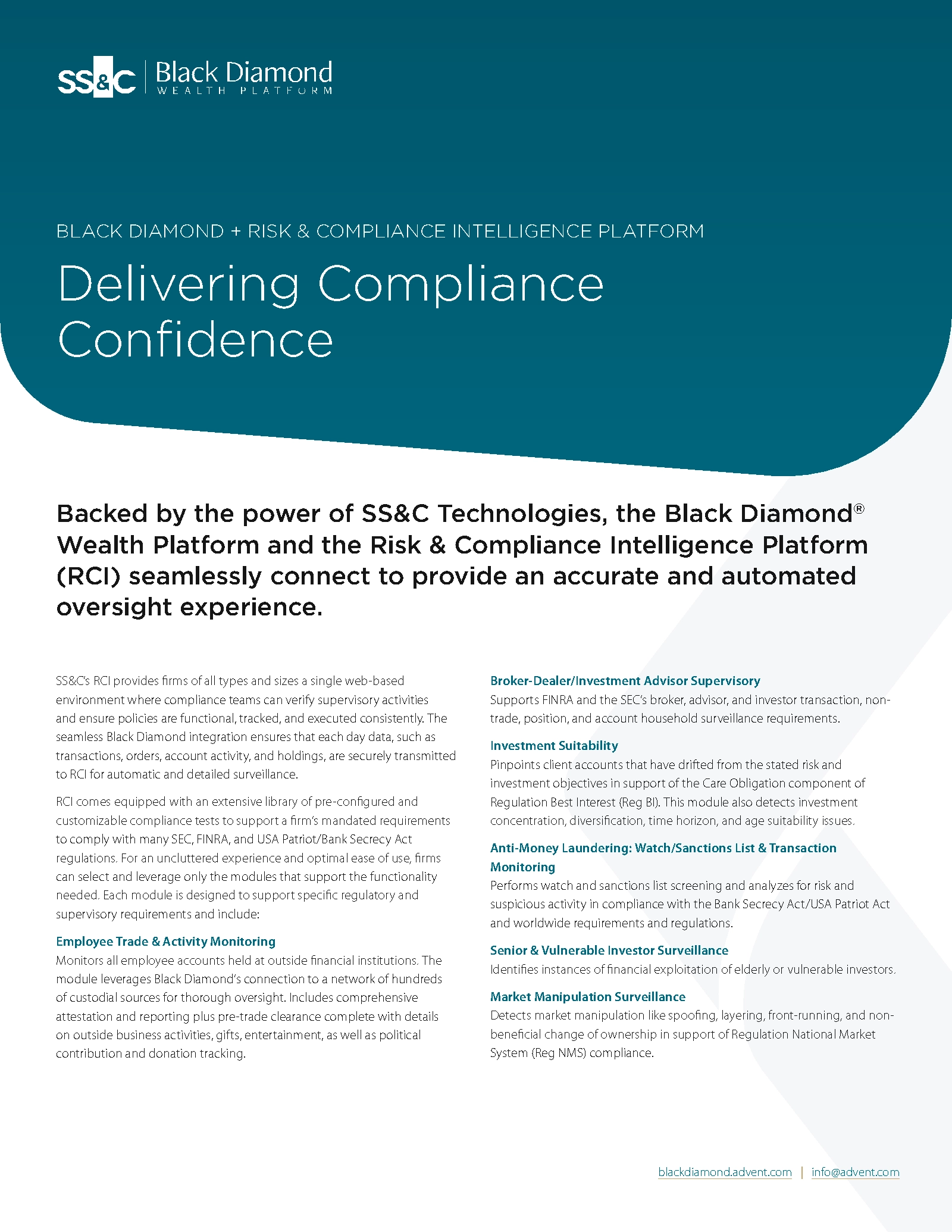

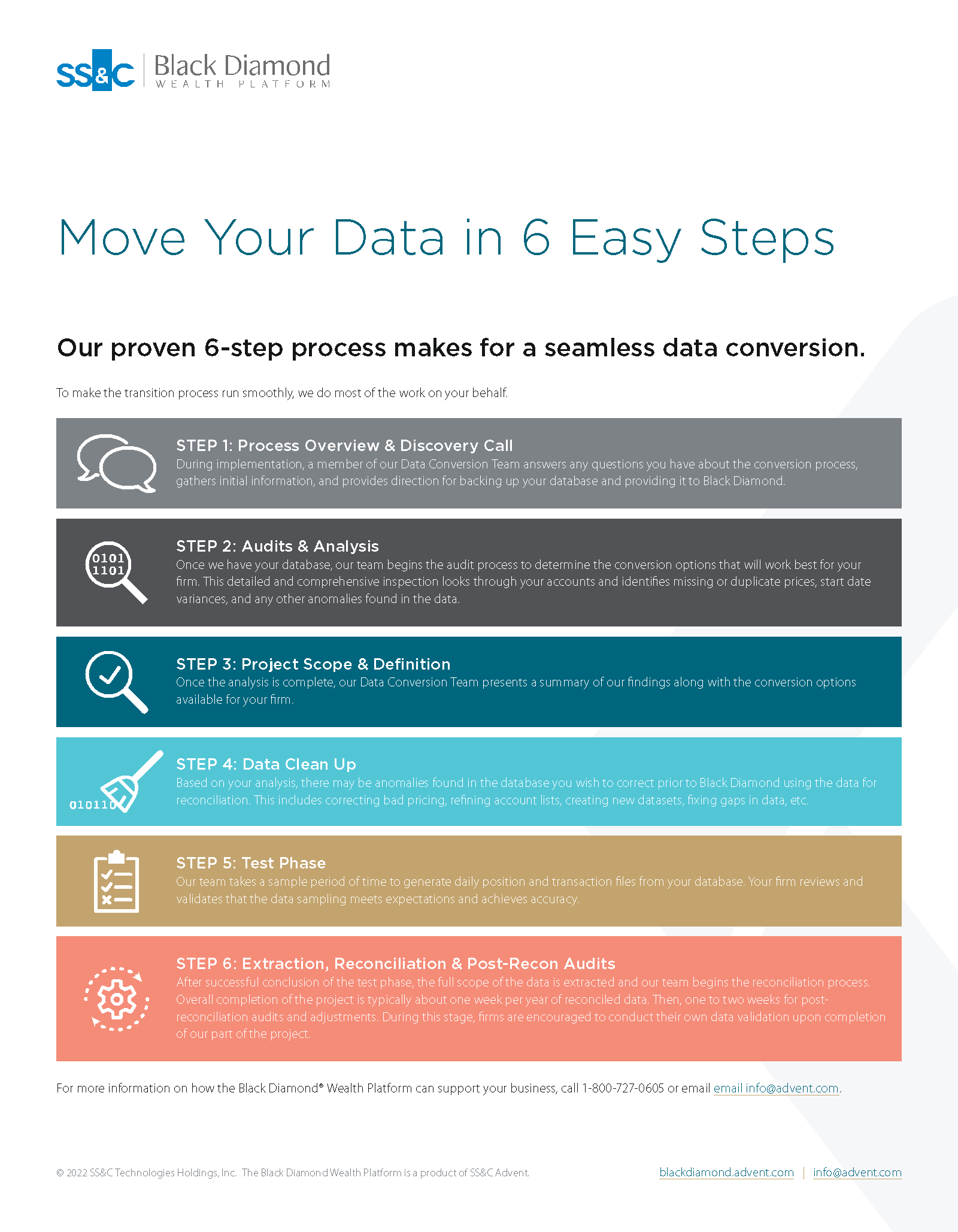

Learn even more about Black Diamond with these product briefs, case studies and whitepapers.

Product Briefs, Case Studies and Whitepapers

Learn even more about Black Diamond with these product briefs, case studies and whitepapers.

Client and Leadership Testimonial Videos

Hear from Black Diamond leadership and clients on what separates us from the rest.

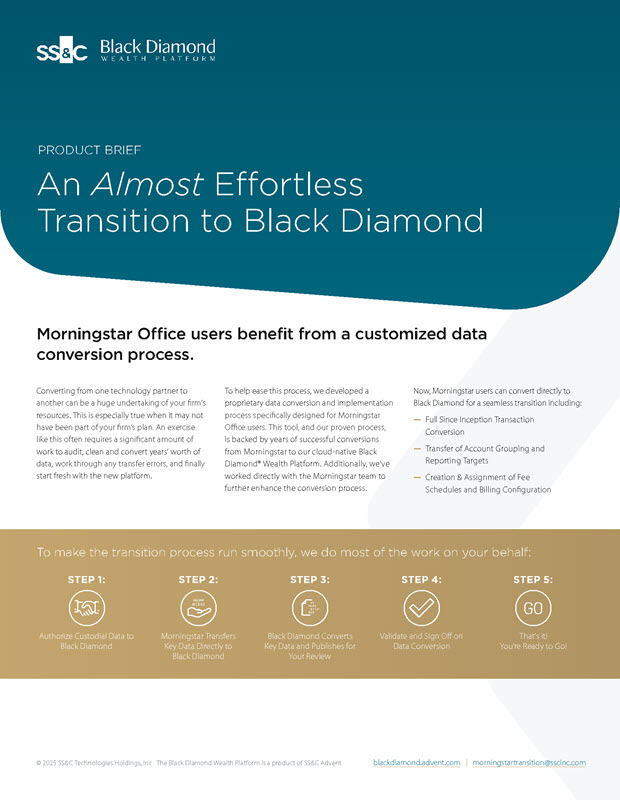

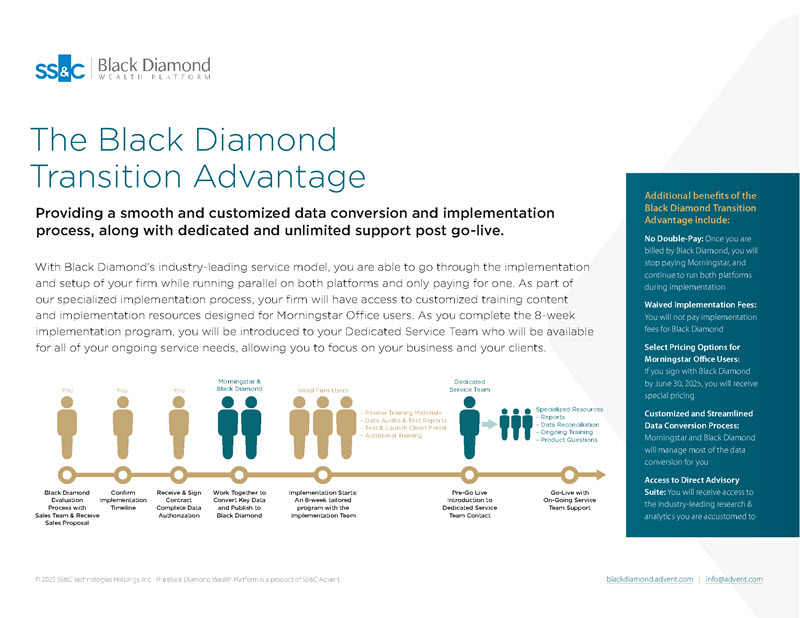

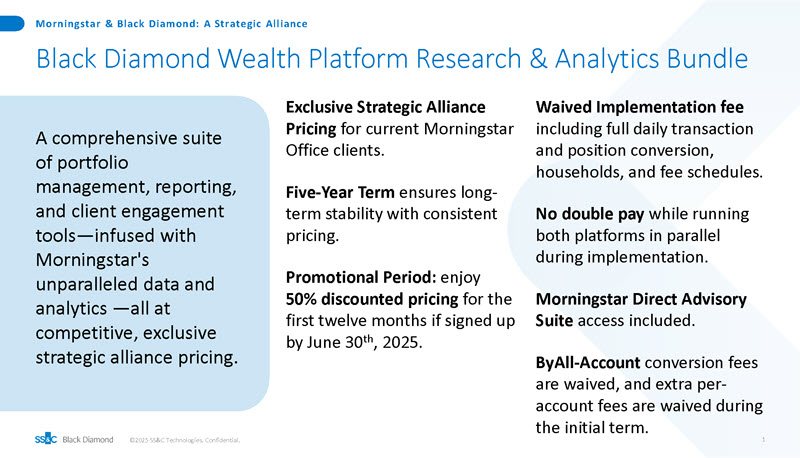

Black Diamond & Morningstar Office | A Strategic Alliance

Learn about the Black Diamond Wealth Platform Research & Analytics Bundle, exclusive for Morningstar Office users.

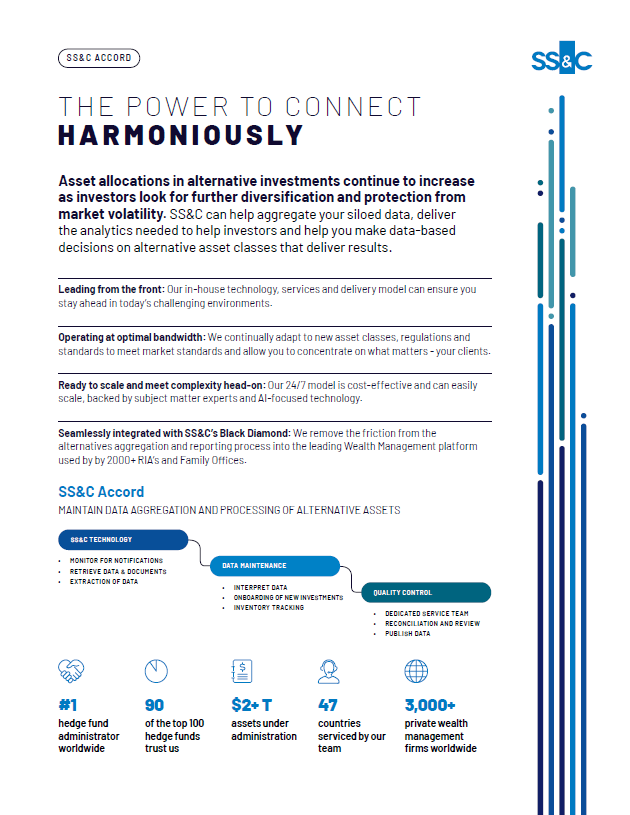

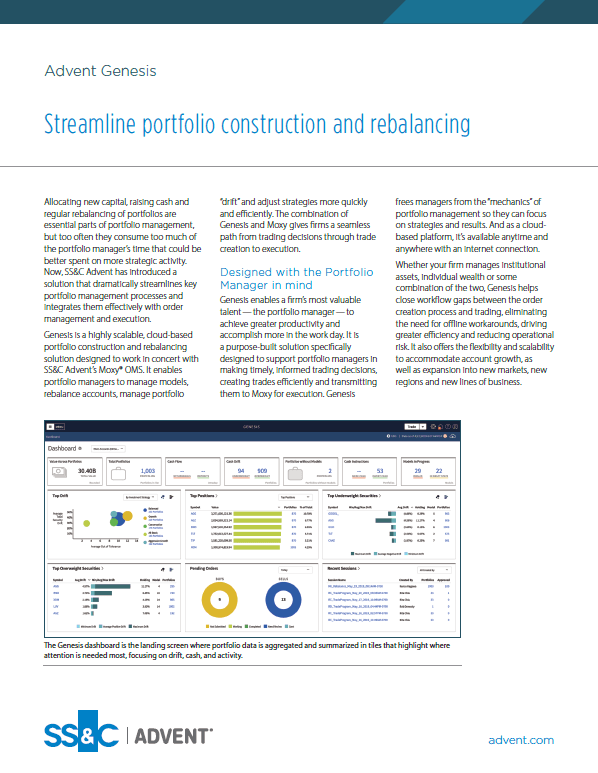

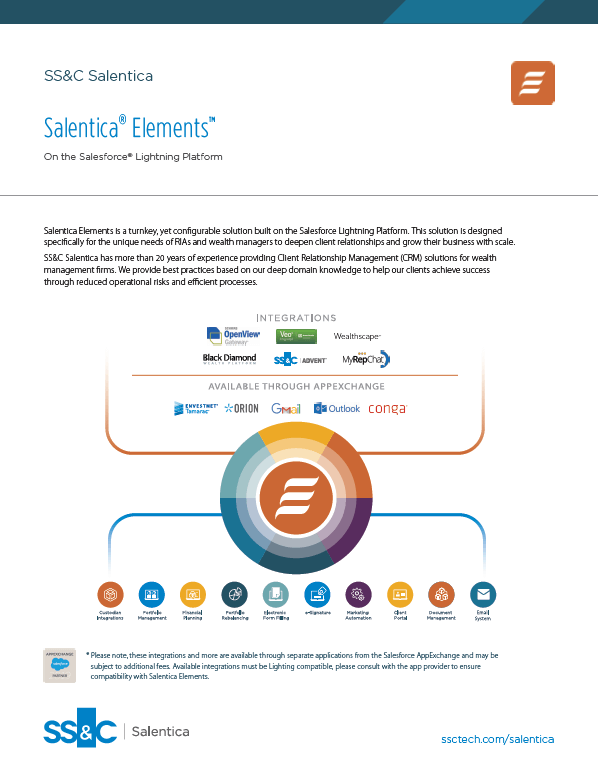

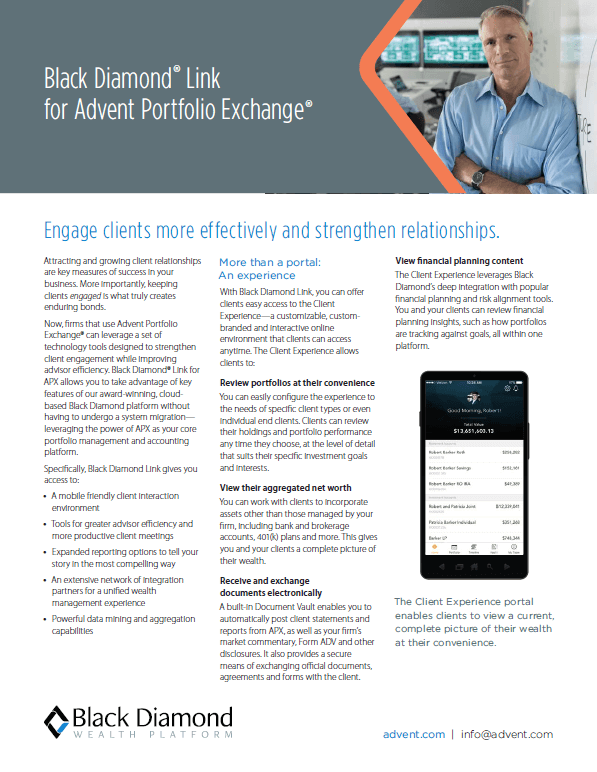

Additional SS&C Solutions

Additional offerings from within the SS&C Ecosystem.

By The Numbers

Check out the depths of our powerful relationship below.3,000+

Total firms

on Black Diamond

$3.6T+

Assets under administration

on Black Diamond

8M+

Total accounts

on Black Diamond

837K+

Active firm and

client users

130

Goldman Sachs Firms

using Black Diamond

$13B

Assets under administration

from mutual Goldman Sachs -

Black Diamond firms

11K

Goldman Sachs accounts feed daily

into Black Diamond

241

Goldman Sachs and

SS&C Advent firms*

*Data includes Black Diamond, APX, Axys and AOS clients.